Forex is an abbreviation for FOReign EXchange. According to the Oxford Advanced Dictionary, Forex is the system of exchanging the currency of one country for that of another country, or the place where currencies are exchanged.

There are several versions of the origin of the Forex Market. According to one of the most popular, it is considered that the history of Forex began more than 500 years ago in Amsterdam, where the exchange took place between agents acting in the interests of the Kingdom of England and the County of Holland.

Another version considers that Forex originates from biblical times.Thus a letter from Demetrios to Apollonios dated 258 B.C. describes a case of coin exchange in ancient Egypt.

Quickly select a jurisdiction and register your company anywhere in the world online

In terms of trading volume, it is by far the largest market in the world.

For a more detailed understanding of the EU forex market, we have explored some key data:

- Record trading volumes in the Forex market: According to data from Reuters, the Forex market experienced record daily trading volumes of $7.5 trillion on October 27, 2022.

For comparison, this means that the daily trading volume of the Forex market on October 27, 2022, exceeded the entire annual economic output of almost every country in the world except the United States and China.

- Euro Currency Trading Volume (2022): According to Statista’s latest report, the average daily trading volume of the euro on the forex market exceeded $2.29 trillion in 2022, showcasing a significant increase from the $470 billion recorded in 2001.

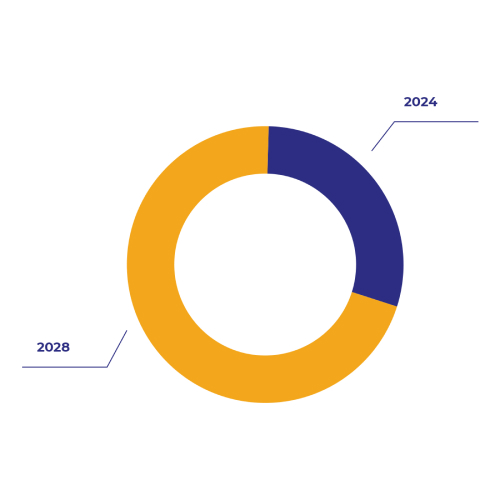

- Market Growth Forecast (2024-2028): The foreign exchange market is projected to grow at a compound annual growth rate (CAGR) of 6.5%, increasing from $795.91 billion in 2024 to $1,023.91 billion by 2028.

European Forex License: Types and Forex regulation in Europe

In the European Union Forex services are regulated by the same legislation as investment services. Obtaining a license in the EU is a one-time process and does not have an expiration date.

Legal regulation of Forex in the EU is divided into 2 levels:

- European Union (level 1). At the EU level, the Forex market is regulated by one main Directive, two Regulations, and the decisions (measures) of the European Securities and Markets Authority.

- MiFID II (Markets in Financial Instruments Directive II) regulates activities of Forex companies and establishes the requirements for licensing. Activities covered by MiFID II include, but are not limited to, accepting and transmitting client orders, executing orders on behalf of clients, portfolio management and investment advice.

- EMIR (European Market Infrastructure Regulation) does not regulate Forex activities directly, but regulates transactions involving derivative financial instruments such as swaps, options and forwards. This Regulation establishes risk mitigation methods for OTC (off-exchange) derivatives.

- GDPR (General Data Protection Regulation) regulates the collection, processing and storage of personal data of EU users of Forex companies. Even though this Regulation does not directly regulate speculative Forex activities, it establishes standards for the personal data protection and confidentiality.

- ESMA (European Securities and Markets Authority) takes measures (decisions) regarding certain types of Forex activities. For example, in 2019, ESMA established leverage limits for retail clients: 30:1 for major currency pairs and 2:1 for cryptocurrencies.

- National (level 2). Since MIFID II is a directive and not a regulation, it requires implementation of its provisions at the level of each country of the European Union. Each EU country has its own legislation regulating Forex activities.

For example, in Germany, the licenses for Forex activities are granted by the local regulator BaFin (Federal Financial Supervisory Authority) within the legal framework of the Securities Trading Act (Wertpapierhandelsgesetz, WpHG).

In France, the licenses for Forex activities are issued by the local regulator, AMF (Autorité des Marchés Financiers), within the framework of the Monetary and Financial Code (Code monétaire et financier).

This legislation is harmonized with MIFID II and establishes additional requirements and obligations for Forex companies to comply with both EU and national legislation.

Types of European Forex licenses

According to CRD IV (Capital Requirements Directive IV), investment firms and forex companies can be divided into 11 categories, depending on the activities they conduct pursuant to MIFID II and whether they hold their clients’ funds or assets.

| Type | Minimum Capital Requirement |

| Companies offering only reception, transmission, and investment advice, registered under the Insurance Mediation Directive (IMD) (Article 31(1) CRD IV) | €25.000 |

| Local companies (Article 30 CRD IV) | €50.000 |

| Companies engaged in the reception and transmission of orders as well as providing investment advice (Article 31(1) CRD IV) | €50.000 |

| Companies involved in executing orders or managing portfolios (Article 31(1) CRD IV) | €50.000 |

| Companies engaged in the reception and transmission of orders as well as providing investment advice, registered in accordance with the Insurance Mediation Directive (IMD) (Article 31(2) CRD IV) | €50.000 |

| Companies not authorized for deals on own account or underwriting, not holding client assets (Article 29(3) CRD IV) | €50.000 |

| Companies holding client assets without authorization for own-account transactions but hold client assets (Article 29(1) CRD IV) | €125.000 |

| Commodity derivatives companies that are not exempt under Markets in Financial Instruments Directive II (Article 28 CRD IV) | €50.000 to €730.000 |

| Companies that only engage in own-account trading without holding client assets or serving external clients (Article 28(2) CRD IV) | €730.000 |

| Companies solely engaging in own-account transactions to fulfill client orders (Article 28(2) CRD IV) | €730.000 |

| Companies that manage a Multilateral Trading Facility (MTF) (Article 28(2) CRD IV) | €730.000 |

| Companies solely executing own-account transactions without external client engagement or holding their assets (Article 28(2) CRD IV) | €730.000 |

| Companies not included in previous classifications (Article 28(2) CRD IV) | €730.000 |

Since MIFID II does not directly separate investment companies and forex companies, it is necessary to determine the appropriate type of authorization (license) based on the business model of each specific project.

Additional to the minimum capital requirements, depending on the type of license, different requirements may apply for physical presence in the country issuing the license, including office, local employees, their position and experience.

General EU forex license requirements include the following:

- Shareholders must have an impeccable business reputation.

- Board members require an impeccable business reputation, as well as the necessary education, experience, and professional qualifications to manage a company.

- A permanent representation in the country where the application for a license is submitted.

- Compliance with laws and regulatory acts on anti-money laundering and terrorism financing.

The Importance of Regulatory Standards in the European Forex Market

While the requirements for obtaining a european forex license are high and established to protect the european financial system from fraud or insider dealing. The unified requirements provide significant advantages to companies that obtain a forex license in europe.

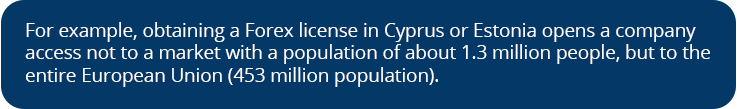

In the EU there is a mechanism of “passportization” of financial licenses, which allows a company licensed in any of 27 EU member states to provide its activities, including marketing on the territory of the entire European Union subject to certain conditions.

Based on the MiFID II directive, clients with a national license in one of the EU Member States may engage clients from entire European Union, subject to the following conditions:

- Article 35(1) MiFID II: Companies must be authorized and supervised by the competent authorities of the Member State in which they have obtained a national license.

- Article 35(2) MiFID II: When providing services to clients from other EU Member States, companies must comply with the rules established by the country of incorporation.

Article 39(1) MiFID II: Companies have the right to conduct their activities in other EU Member States via the establishment of branches. - Article 39(2) MiFID II: When providing services in other EU Member States, companies must comply with the rules laid down by the Member State where they provide services.

This mechanism is unique to the EU and Complying with these conditions, Forex Companies can attract clients from the entire European Union on the basis of a single national license.

Who needs a Forex license in the EU?

Primarily, a Forex license in the European Union is needed for all companies that plan to provide services in the EU with their active marketing.

Benefits of having a European forex license include, but are not limited to, the following capabilities:

- Active marketing of Forex services to clients in the EU, including active marketing with proposals to use the company’s services.

- Possibility to offer all services in the EU for which company has authorizations.

- Ability to offer all services in the EU for which the company has authorization including advertising in Google, Meta, etc.

Additional advantages include the opportunity to effortlessly establish a corporate bank account for Forex operations in European banks, as well as the capability to collaborate with European liquidity providers and major European financial institutions.

In this scenario, obtaining a single European forex license is a reasonable investment despite the high requirements and costs related to its obtaining.

Who is not required to obtain a forex license in the EU?

European investment and financial legislation is quite flexible and provides cases in which a Forex company with a non-European license can provide services in the EU.

According to Article 42 of MiFID II non-EU Forex Companies may operate in the EU without the requirement for national licenses if they provide services on the exclusive initiative of a client.

To provide Forex services without obtaining a national license, it is necessary to comply with the following conditions:

- Initiative by the client. Ensure that services or activities are initiated exclusively by clients established or located in the EU. This means that services are provided at the client’s request without prior proposal from the company.

- Marketing restrictions. Companies must not market new categories of investment products or investment services to EU clients.

- Communication with clients. Services are considered initiated by the client if they are not requested in response to a personalized communication from the company or on behalf of the company to a specific client.

- General proposals. A service may be deemed to be provided at the initiative of the client, even if the client requests it on the basis of any general proposal made by any means that are general and addressed to the general public.

Subject to these conditions, companies will be able to conduct their activities in the EU on the basis of a license obtained in a non-EU country.

This scenario is optimal in situations where the company’s activities are not specifically focused on the European Union and the business model does not provide for high administrative expenses associated with obtaining and maintaining an EU license.

Our expertise to meet your challenges

Legal regulation of the Forex market is one of our core specializations. In particular, we provide full support in obtaining Forex licenses not only in the EU, but also in UAE, Canada, Mauritius, Seychelles and Comoros.

Our advantages include significant experience with Forex projects and related experience in legal regulation of cryptocurrencies, payment and financial institutions.

Each implemented project is not simply a forex licensing process, but a balance between strategy and implementation. We at Fintech Harbor Consulting do not offer general solutions, but create individually tailored solutions for each specific business model and strategy.