Crypto license in Poland

Poland is a member of the European Union. The country is located in Eastern Europe near Germany, Austria, the Czech Republic, and the Baltic countries. Some time ago, Poland ran a new policy that regulates virtual assets. The state government relies on digital technologies, and the country hosts many IT EU-registered companies like Egera, BitBay, BitStamp, and BitFinex. Poland, in a really short period, shows a loyal regulation of business activities with virtual assets, making it a very attractive jurisdiction for obtaining a VASP license Poland. Additionally, the favorable framework encourages investors to apply for crypto license Poland for both regulatory and tax benefits.

Overview of Cryptocurrency Market in Poland

For a more detailed understanding of Poland’s digital asset market, we have explored some key data:

Expected Revenue (2023): According to Statista’s latest report, the revenue in 2023 could reach €279 million.

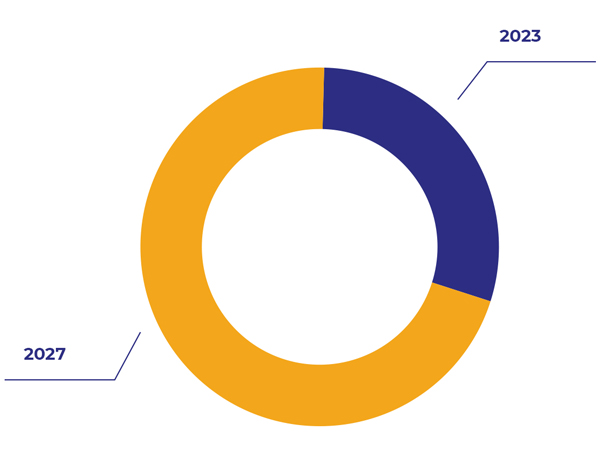

Projected Development (2023-2027): The Polish digital assets market is projected to grow at an approximate Compound Annual Growth Rate (CAGR) of 11.48% from 2023 to 2027. With this rate of expansion, the market’s valuation might potentially hit €431.5 million by 2027.

Revenue per user (2023): The average revenue per user in the Polish digital asset market is expected to reach €46.6 in 2023. This indicator shows the profitability of the VASP crypto market.

Revenue comparison: According to forecasts, the digital asset market in Estonia in 2023 could reach €14.91 million. This means that the Polish digital asset market will be almost 20 times larger than the Estonian market.

User growth forecast: The number of users in Poland’s digital asset market is forecast to grow significantly. It is estimated to reach around 7.85 million users by 2027. In fact, this means that every 5th person in Poland will use digital assets.

User Penetration Rate: The rate of digital asset use in Poland will grow from 15.9% in 2023 to 21.0% by 2027. This growth indicates the increasing usage of digital assets in Poland.

Poland as a crypto-friendly country

The Definition of the Crypto License

Since, based on the name, we can determine that the Polish version of the authorization to conduct activities with virtual assets is not a license (in its usual sense), it is necessary to make a point on this.

Polish crypto-authorization is an entry in the state registry of companies that conduct virtual-related business, maintained by the Chamber of Tax Administration (e.g., in Katowice).

Crypto license in Poland is officially called “Polish crypto-authorization.” It allows your company to perform these types of business activities:

- Exchange between virtual currencies and fiat money (for example, EUR to BTC or BTC to USD);

- Exchange between virtual currencies (for example, BTC to LTC);

- Brokering in exchange;

- Keeping accounts related to crypto assets (custody services).

This record in the state register is permission for business entities to build a business on commercial activities with virtual assets, so obtaining additional documents is not necessary.

The following data are included in the register for public viewing:

- Registration number (crypto-authorization) of the company;

- Date of authorization;

- KRS number (person number in the national court registry);

- NIP number (taxpayer identification number, TIN);

- Type of activity for which the company is authorized.

Why Poland is interesting as a crypto business jurisdiction?

- Poland is developing as a crypto-hub

- Loyal attitude to the development of virtual assets

- Easy and favorable business registration procedure

- Opening a business without the physical presence

European “residence” of the company

- The advantage of being a reputable European company;

- A wide range of banks to open an account for you;

- More favorable maintenance of the company’s accounts.

Poland is more relevant and profitable

- Low requirements for the authorized capital of the company;

- Virtually no restrictions on your citizenship, unlike in other countries;

- Preferential tax rates for businesses based on virtual assets

Our awards

How much does it cost to obtain the license?

The VASP license cost Poland is €8,000.

Why should you choose Fintech Harbor Consulting to receive Polish crypto authorization?

Even though at the moment Poland provides a fairly transparent legal basis for obtaining cryptocurrency exchange license Poland, it can be quite problematic without legal support.

To get a Poland crypto license, first of all, it is necessary to register (or buy) a company in Poland, which will have the corresponding business activity identifiers. Our company offers the service of registering a legal entity in the form of an LLC in Poland because this form is the most flexible both in terms of citizenship of company members and financially.

The next step is to open a bank account. Our company offers to open an account with a local European bank, which will only be an advantage for your business. To open a bank account, you will need to go through the process of complying with international anti-money laundering and counter-terrorist financing policies. In addition, you will need to prepare standard documentation to show that your company is compliant with the “know your customer” policy.

Fintech Harbor Consulting attorneys have extensive experience in starting companies and obtaining licenses all over the world, including Poland. We can take care of all legal matters while you do business!

Requirements for obtaining a Crypto license in Poland

- No criminal record. In accordance with Article 129n of the Polish AML Act, the directors and authorized persons of the company must not have a criminal record for an intentional crime.

- Knowledge and experience in the field of digital assets. Under Article 129o of the Polish AML Act, authorized persons must have knowledge or experience related to digital assets. This requirement is considered fulfilled in case of completion of a training course in the field of digital assets, supported by documents.

- Initial capital. In Poland, there are no initial capital requirements for obtaining VASP authorization. But, according to Article 154 of the Polish Commercial Companies Code, the minimum initial capital for registering a limited liability company is zł5,000.

Types of Poland crypto licenses

Under Article 2, paragraph 12 of the Polish AML Act, the permitted activities for a virtual asset service provider include:

- exchanges between virtual currencies and means of payment.

- exchanges between virtual currencies.

- brokering in exchange;

The AML Act does not specify that these types of activities need different authorizations. This means that you can get a VASP license in Poland and provide all types of services on the basis of a single Poland crypto license.

Registration of cryptocurrency company in Poland is simple and involves 3 steps:

- Getting Pesel and ePUAP

- Registering the company in Poland

- Applying for VASP authorization and preparing AML policies.

Once these steps are done, the company will be registered in Poland with the needed AML documents and added to the VASP registry.

The strategy for starting a crypto business in Poland

Initially, to run an official and legal business in Poland, you need to register a legal entity in Poland under Polish law. It is your legal entity that will have permission to obtain a crypto license in Poland. Proper licensing guarantees the protection of your business.

The routine of acquiring a Poland crypto license consists of the subsequent steps:

- Signup and run a domestic legal entity (in the legal form of Sp. z o.o.);

- Setting up a local business office (not required a physical office) with ZIP-code;

- Opening a corporate bank account in Poland (or EU);

- Registering information about the company in Polish registers (legally binding);

- Preparing of information about company officials (Director(s), UBO(s), shareholder(s), required documentation, policies AML/CFT, KYC;

- Collecting of documents confirming the official origin of funds;

- Applying in Polish Tax Service for authorization;

Fintech Harbor Consulting specialists will help you both with Poland crypto regulation consulting and with crypto company setup in Poland, obtaining a license and other necessary documentation. We will accompany you at all stages.

New legislation affecting the crypto industry

Until November 2021, virtual assets were not regulated by Polish law. It was at that time that amendments to anti-money laundering and anti-terrorist financing legislation were adopted, as such requirements were imposed by the European Union on local legislation. On that basis, the Polish government regulated business activities with virtual assets to the norm that exists now.

Let’s take a look at the basic requirements and changes in Polish law that are valid now.

1. Application process

Since previously no special permission was needed to conduct crypto-businesses (virtual assets succumbed to the rules of general civil circulation), the main change was the obligation to obtain special permission for this type of activity.

2. Firm employees

The local regulator is very careful about all employees who are registered in the company, and especially about the composition of the management and owners (beneficiaries) – information about them must be listed in official documents, as well as in the State Court Registry.

3. Anti-money laundering (AML/CFT FATF policies)

Since the above legislative changes mainly concern these policies, they are the main focus. It is the responsibility of the company to develop regulations to ensure that no money laundering or terrorist financing can be conducted through the company. These regulations will be checked both at the licensing application stage and at the opening of the bank account.

4. Corporate account

5. Governmental duty

Obtaining a crypto license in Poland at the moment consists of two main stages:

- opening a legal entity – initial capital of zł5,000 (€1,200)

- payment of state fees for the application (about zł600)

We can conclude that against the background of the complexity of the process of opening a cryptocurrency business in other European countries (e.g. Lithuania) in Poland it is easier, faster, and more profitable!

Crypto taxes in Poland

When you start a crypto company in Poland, your business becomes a tax resident. This means your company is added to Poland’s list of taxpayers.

The following taxes apply to companies registered in Poland:

- Tax on company profits – 19%;

- The taxable base is the positive difference between the sale price and the purchase price of the assets;

- Capital gains tax – 19%.

- VAT basic rate – 23%.

If a company is based in Poland, it typically has to pay taxes on its global earnings. But some international tax agreements may exempt the company from paying Polish tax on foreign income. Companies not based in Poland only pay taxes on the income they generate within the country.

The standard corporate income tax rate is 19% and it applies to most goods and services. A 9% corporate income tax rate applies to income, except for capital gains, under two conditions:

- The taxpayer is small, meaning their sales revenue, along with VAT, was under about €2 million last fiscal year.

- The company is new and wasn’t formed by merging or transforming an existing business in its first tax year.

VAT is charged on each taxable supply of goods and services, in other words, on each supply of goods and services made in Poland by a taxable entity in the course of its business activities, unless such supply is exempt from tax according to the provisions of the law.

The following value-added tax rates apply in Poland:

- 23% – the standard rate for most goods and services;

- 8% – reduced rate (applies to pharmaceuticals, certain transport services);

- 5% – reduced rate (applies to books, journals, and basic, unprocessed food);

- 0% – for all exceptions provided for in the Polish VAT Act (for example, export of goods to countries outside the EU).

In Poland, company taxes are lower than the EU average, making it an attractive place for crypto-businesses.

European case law on the application of VAT to cryptocurrency transactions

In a landmark decision in 2015, the European Court ruled that the purchase of bitcoins or other cryptocurrencies is exempt from Value Added Tax (VAT) for EU member states.

Case Summary:

Mr. Hedqvist wanted a clear interpretation from the Swedish Revenue Law Commission about how VAT applies to Bitcoin transactions.

The main question in this case was about how to understand Articles 2(1)(c), 135(1)(d), 135(1)(e), and 135(1)(f) of the EU VAT Directive.

The court decided that Bitcoin is a type of payment contract. It lets direct transactions happen between parties that accept it.

The court decided that trading traditional currencies for bitcoins is a service. It falls under Article 2(1)(c), as it includes the difference between the buying and selling price of the currency.

Bitcoin transactions don’t meet the exemption criteria under this Article. Bitcoin doesn’t match the specific financial instruments described.

The court said that Article 135(1)(e) covers transactions involving non-traditional currencies like Bitcoin if they are an accepted alternative to legal tender. This means these transactions don’t have to pay VAT.

As Bitcoin isn’t a security that gives a property right or a similar security, transactions involving it don’t fall under Article 135(1)(f).

Impact on Poland:

While the ruling isn’t a guaranteed rule stating VAT won’t be applied to digital currency dealings, it’s had a considerable effect on Poland’s burgeoning crypto sector.

Based on this decision from 2015 and clarification (0114-KDIP4-3.4012.652.2022.3.IG), the Polish tax authorities maintain that cryptocurrency payments for IT services are barter and are not subject to VAT. In this case, they rely on EU legislation and previous court decisions. So, businesses in Poland can pay with crypto and stay clear of VAT.

This lets business owners pay with crypto without extra taxes, helping it grow more popular in Poland.

For those looking to secure crypto license Poland, the Poland crypto license application process has become more streamlined due to these regulatory frameworks.

The legal framework applicable to cryptocurrency companies

To apply for a VASP license in Poland it is important to know legal framework. At the moment, Poland does not have a Law or national approach to the regulation of cryptocurrency.

The same old rules for finance and anti-money laundering (AML) are used. The main financial authority, called the Polish Financial Supervisory Authority (PFSA), monitors the cryptocurrency market, but does not issue any special licenses. Instead of a license, you need to apply for VASP authorization. If a crypto acts like a traditional investment, the PFSA will get involved. Also, if you run a crypto exchange, you have to follow AML rules. If a crypto acts like a traditional investment, the PFSA will get involved. Also, if you run a crypto exchange, you have to follow AML rules. The PFSA has issued some guidelines on crypto, but that’s about it.

Poland governs crypto trades using its Polish AML Act, which aligns with the EU’s 5AMLD.

According to paragraph (26) of Article 2 of the Polish AML Act, virtual currency means a digital representation of value that is not:

- A legal tender issued by government agencies or foreign central banks.

- An international payment unit established by international organizations.

- “Electronic money” as defined in the Payment Services Act 2011.

- A financial instrument as defined in the Financial Instruments Trading Act 2005.

- A bill of exchange and a cheque.

This definition resembles that in Article 3 of the MiCA, which describes a ‘crypto-asset’ as a digital token of value or rights. They can be stored and moved electronically using distributed ledger technology.

Reviews

FAQ

The main stages of obtaining Polish crypto authorization

To enter the registry of companies that work with virtual assets, you need:

Prepare corporate documents of the company, as well as the person authorized to represent the interests of the company;

- Incorporation documents (Articles of Association, Memorandum);

- Certificate of shareholders;

- The registered address for the company;

- ID for Representative (passport)

Other required documents.

Pay currently at a cost of zł616 ( €135); - Complete the procedure required by the Anti-Money Laundering Law.

After obtaining Polish authorization the main necessity is to open a bank account to be able to make payments and profit from their products and services.

Since Polish crypto-authorization is an officially adopted governmental decision (and Poland is within the European Economic Area), customers can open an account at payment institutions (such as Revolut, Bankera, and others). They allow you to open an account quickly, reliably, and, most importantly, without the physical presence of an authorized person. Everything can be done remotely.

But if you consider it necessary to open an account in a traditional bank, these options are also possible, but you should pay attention to the pricing policy and the possibility of the necessary physical presence to open an account.

How much time do you need to get a crypto license?

Is crypto legal in Poland?

Yes, cryptocurrency is legal in Poland and is described in the Polish AML Act.

According to paragraph C (26) of Article 1 of the Polish AML Act, virtual currency means a digital representation of value that is not:

- A legal tender issued by government agencies or foreign central banks.

- An international payment unit established by international organizations.

- “Electronic money” as defined in the Payment Services Act 2011.

- A financial instrument as defined in the Financial Instruments Trading Act 2005.

- A bill of exchange and a cheque.

How to obtain a crypto license in Poland?

Obtaining a cryptocurrency license in Poland is simple and involves 3 steps:

- Getting Pesel and ePUAP

- Registering the company in Poland

- Applying for VASP authorization and preparing AML policies.

Once these steps are done, the company will be registered in Poland with the needed AML documents and added to the VASP registry.

What types of activities can be carried out with a cryptocurrency license in Poland?

In accordance with Article 2, paragraph 12 of the Polish Anti-Money Laundering and Terrorist Financing Act, the permitted activities for a virtual asset service provider include:

- exchanges between virtual currencies and means of payment.

- exchanges between virtual currencies.

- brokering in exchange;

- keeping accounts related to crypto assets (custody services).

What are the penalties for running a cryptocurrency business without a license in Poland?

Can non-residents of Poland own a crypto company?

What is the minimum amount of authorized capital for a virtual currency service provider?

In Poland, there are no initial capital requirements for obtaining VASP authorization. But, according to Article 154 of the Polish Commercial Companies Code, the minimum initial capital for registering a limited liability company is zł5.000.